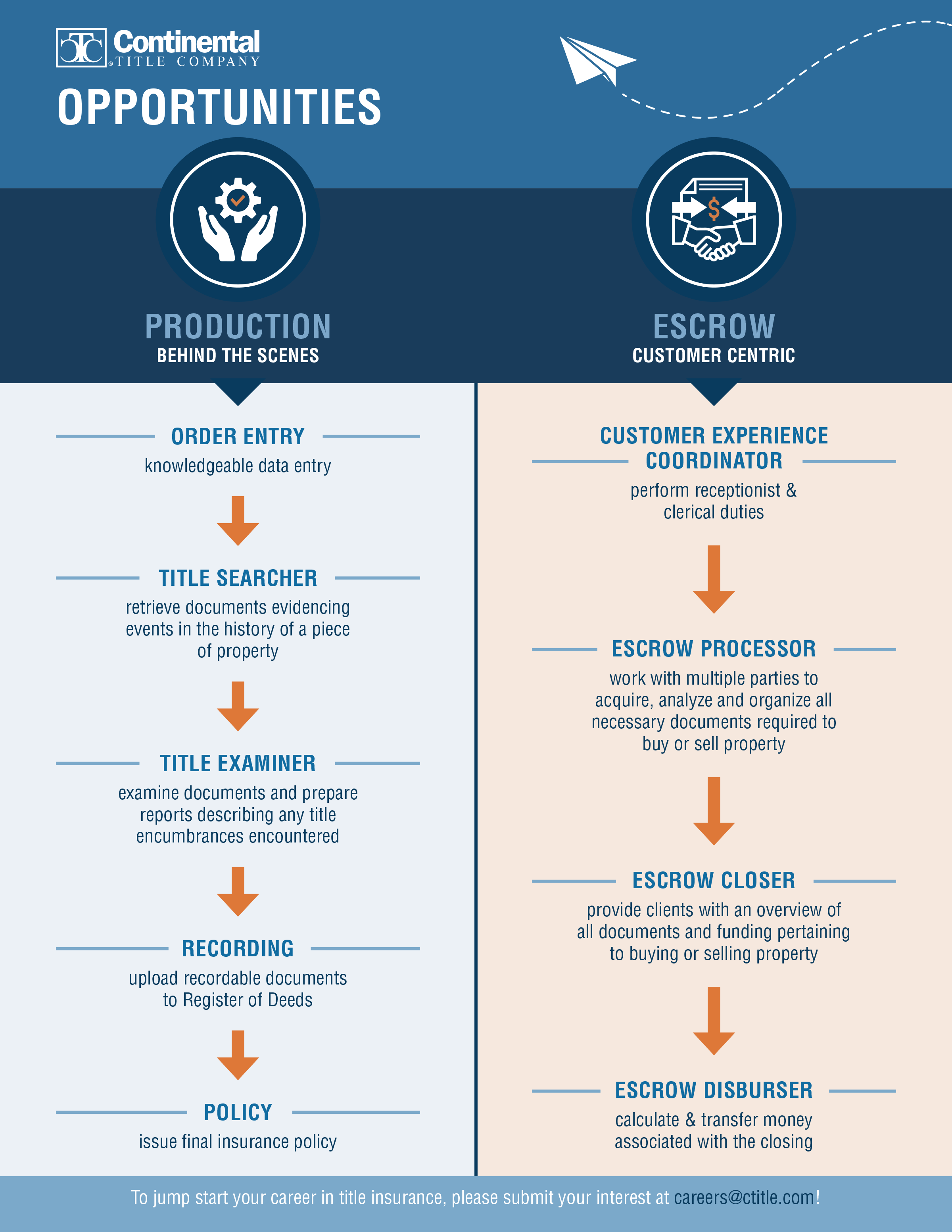

Careers

If you are interested in working at Continental Title Company, please reach out anytime. We’re always interested in talking with people who are experienced with Title and Escrow. Leah Dornes can be reached by call or text at 913-956-8032 or at careers@ctitle.com. Chat soon!

Benefits Information

For eligible employees, Continental Title Company offers a full benefits package including, but not limited to medical, dental, vision and life insurance, short and long term disability, flexible spending account, health savings account, a 401(k) retirement plan with matching, paid time off and paid holidays.