As you’re examining the many expenses related to your potential home loan and purchase, you may have noticed two expenses that seem overlapping at first glance–owner’s title insurance (or the Owner’s Policy) and lender’s title insurance (or the Loan Policy). It makes sense to ask what these are and why they’re there. Both serve as important items for you, and your lender, both now and in the future.

When we normally think of insurance, the first thing that comes to mind is premiums–monthly out-of-pocket payments that we contribute to a shared pool of funds to cover us if something bad happens. This is, right away, how title insurance differs from other insurance you may be familiar with. You only pay for the Owner’s Policy title insurance one time, and it will protect you for the entire length of the time you own your home. The Loan Policy, also different than other insurance, is a one time premium that will provide coverage to your lender until loan is paid off.

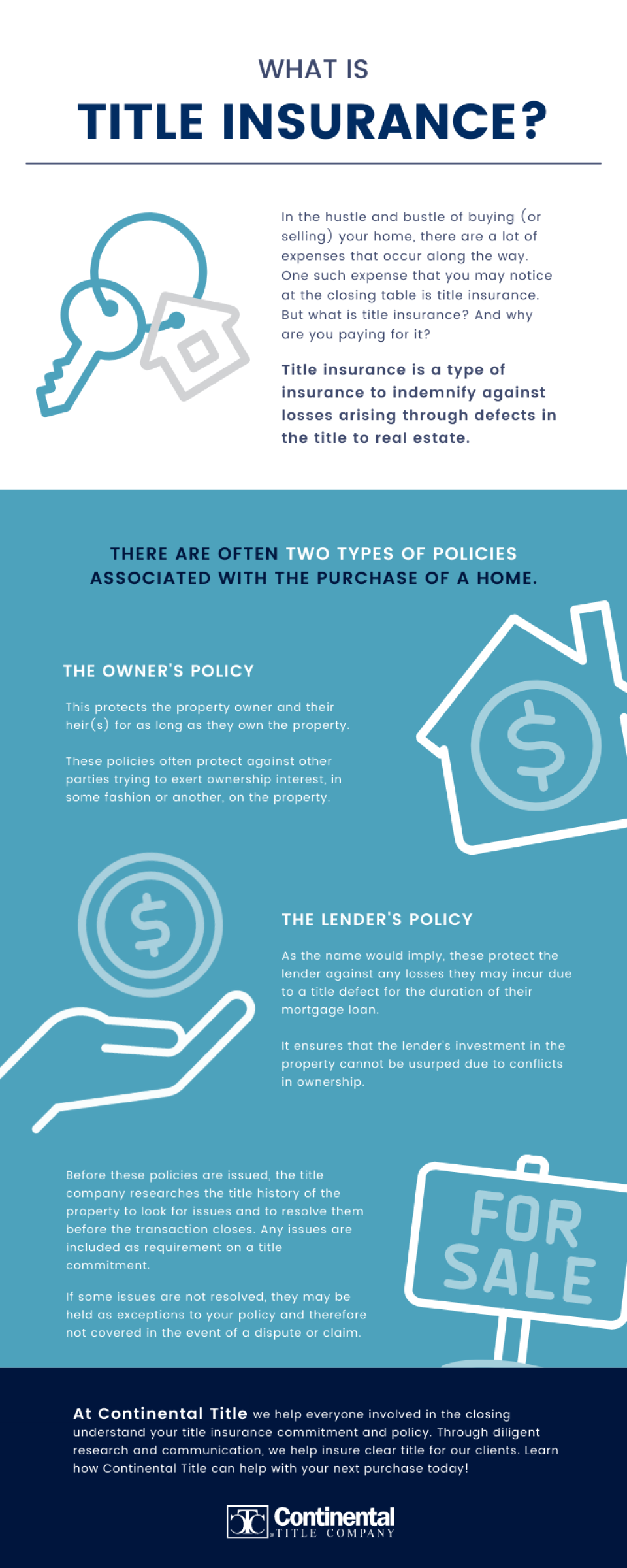

So, that’s great, but what do title insurance policies protect us from, and why are there two of them? Why do I have the Owner’s Policy and the Loan Policy? These are great questions.

You may already be familiar with Homeowner’s Insurance–this is the kind of insurance that protects you in the case of a physical disaster: a fire or a terrible storm and so on. Similarly, the Owner’s Policy protects you from a legal disaster–most specifically, other people or institutions laying claim to your property down the line. If the person who sold you the home originally promised the property to a relative in a will, or if they had liens on the home from construction and improvements, there may be someone out there with a valid claim to your home. Your title insurance policy, issued by your title insurance company, straightens this out and protects you should anyone try to claim ownership interests. Continental Title, in the case of any such challenges, would be behind you every step of the way with legal support.

The Loan Policy, or Lender’s Policy, has a different function. It protects the lender’s interest in the property, which could be challenged by an unknown loan or heir coming out of the woodwork. Both policies ensure that the owner of record has sole ownership interest in the property and that there are no unknown liens or judgements that could cloud the property’s title. As Lender’s Policies facilitate mortgages and protect lenders, they are often a necessary component of a mortgage transaction.

It may be useful to view the cost of these policies as just “the cost of doing business,” similar to other required steps like an appraisal, a home inspection, and so on. It is important to remember that the purchase of a property is a large financial transaction, one of the largest that any individual might make, which requires teams of people working to verify that your home is yours at the end of the day. It will protect and defend you in any legal action that could include an individual or company coming around to challenge your right to your property. Prior to the closing, your title company will do their due diligence and research any potential issues and correct them prior to closing. The policies that they issue highlight the title company’s commitment to back their research both now, and in the future. At Continental Title we work hard to ensure that you can feel confident and secure in your closing transaction.

No matter what your home-buying status is–just looking around or even about to purchase, Continental Title is ready with years of combined experience and compassionate customer service to ensure your home purchase goes off without a hitch.